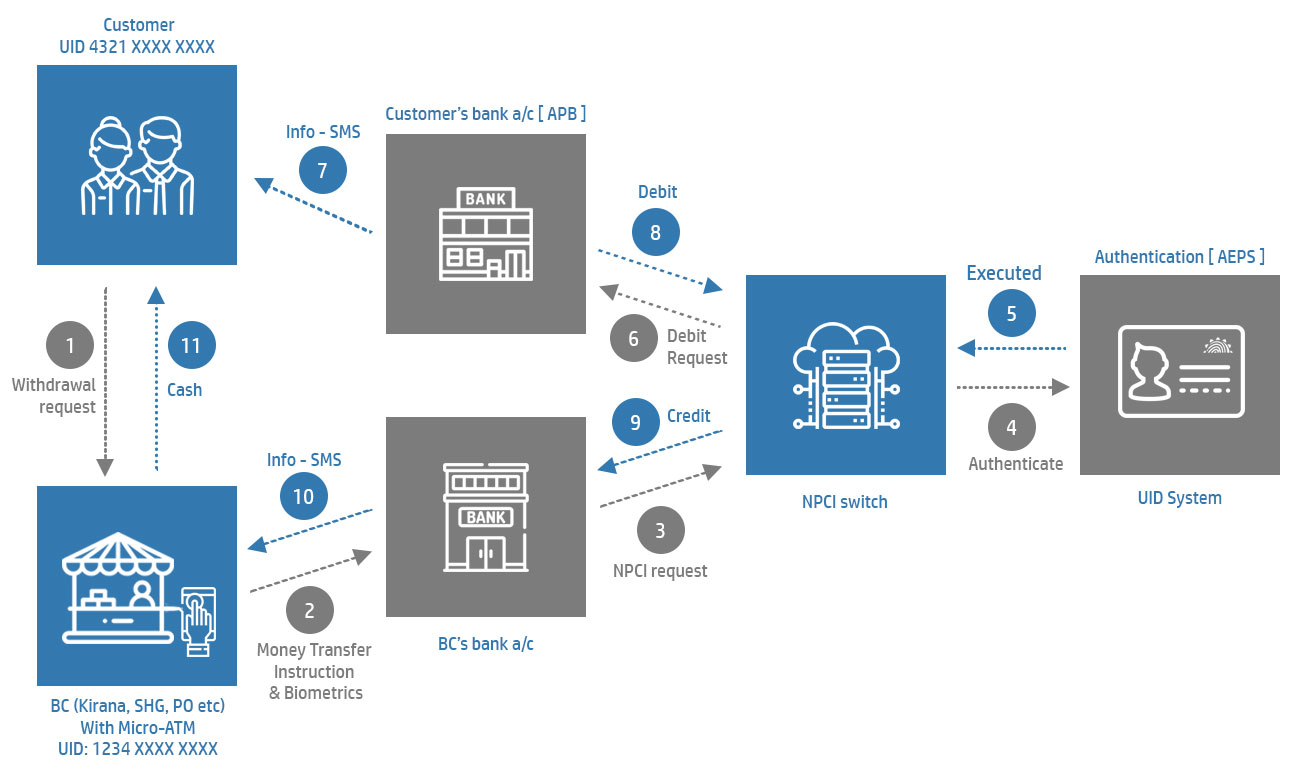

Process Flow for Using AePS

To enable the customer with efficient and smooth banking services, following process is followed in general:

Step - 1The customer makes an amount withdrawal request in front of a bank correspondent (An owner of Kirana store, SHG - self help group, PO - post offices can act as a bank correspondent).

Step - 2The bank correspondent (BC) with the aid of biometric Micro-ATM will make a money transfer request by capturing a biometric fingerprint image of a customer/account holder and entering his UID Aadhaar number.

Step - 3Now, the bank correspondent's bank representatives will make a request to NPCI switch for validating the customer.

Step - 4NPCI switch will send an authentication request to the UID system for validating the customer by matching his Aadhaar number & biometric fingerprint impression.

Step - 5Upon successful authentication of the customer, UID system will send a confirmation message to NPCI switch.

Step - 6NPCI switch will further send a request to debit the withdrawal amount to a customer's bank account.

Step - 7Upon cash withdrawal requisition, the customer's bank will send the SMS to him informing about the debit request.

Step - 8The withdrawal amount will now be debited from the customer's bank and it will connect to NPCI switch again.

Step - 9The cash amount will be transferred to the bank correspondent's bank account from the customer's bank via NPCI switch.

Step - 10The bank correspondent will now receive an SMS from his/her bank account upon customer's withdrawal amount getting accredited to the account.

Step - 11The bank correspondent will lastly hand over the cash amount to the customer and the money withdrawal procedure is successfully completed.